Iran Eyes Strait of Hormuz Closure—Global Energy Markets and India Brace for Impact

In a dramatic escalation of regional tensions, Iran’s parliament has recommended closing the Strait of Hormuz to commercial shipping. This narrow chokepoint, through which roughly a fifth of global oil flows, remains one of the world’s most critical maritime corridors. Iran’s recommendation is a clear signal of its readiness to take aggressive countermeasures against mounting international pressure and unilateral sanctions. But what does this mean for global energy markets and, specifically, for India’s oil import strategy? Here are the key dynamics at play:

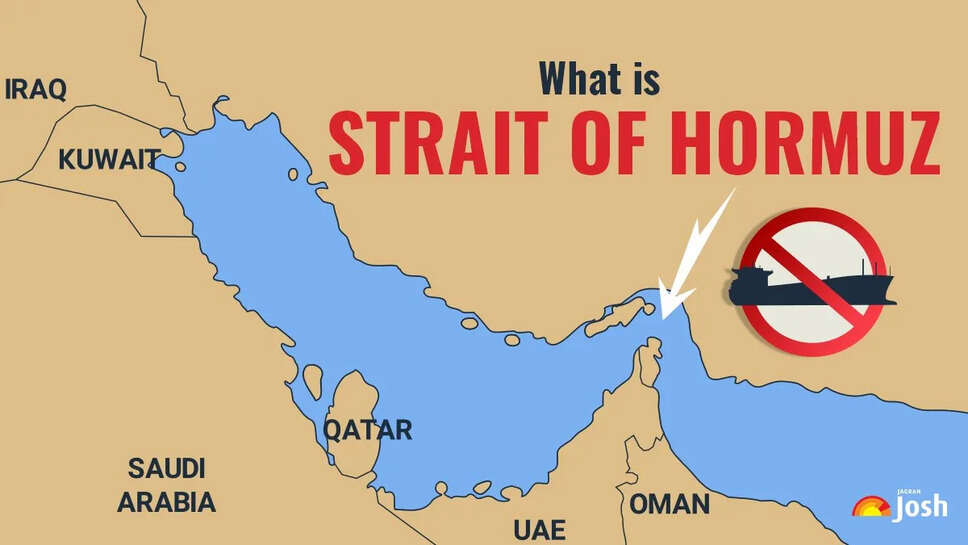

1. Understanding the Strait of Hormuz’s Global Importance

The Strait of Hormuz connects the Persian Gulf to the Arabian Sea and the wider Indian Ocean. Roughly 17–20 million barrels per day (mbpd) of crude and petroleum products traverse this narrow passage—approximately one-fifth of the entire world’s seaborne oil trade. It is not only lifeblood to energy-hungry Asia but also essential to global supply chains. Its closure would instantly ripple through the world economy.

2. Iran’s Strategic Leverage

Iran’s suggestion to close the strait stems from mounting pressure—economic sanctions, threats of military action, and persistent naval patrols by Western powers in the region. Closing the strait would serve as a high-stakes warning, threatening global energy security. It would instantly grab international attention and put pressure on oil-importing nations to weigh in diplomatically.

3. Immediate Impact on Oil Prices

A threatened or actual closure would almost certainly trigger a sharp spike in crude prices. Undelivered supply—or even the credible risk of it—could push Brent and WTI benchmarks into the $120–150 range per barrel within days. Markets hate uncertainty, and with bullish sentiment dominating, rapid speculation could drive prices even higher.

4. Global Market Volatility and Speculation

Expect volatility to soar. Energy traders would likely place aggressive bets on rising prices, prompting margin calls and dynamic hedging. Natural gas markets could ripple too, especially liquified natural gas (LNG) flows from the Middle East. Stock markets globally could falter, particularly in energy-dependent economies. Safe-haven assets like gold, sovereign bonds, and the U.S. dollar would likely rally.

5. Supply-Side Response by Other Producers

With Iran sidelined, other oil producers would scramble to fill the shortfall. Saudi Arabia, the UAE, Kuwait, and even U.S. shale producers would be under massive pressure to ramp up output. OPEC + meetings would become intensely focused on supply quotas and rapid production adjustments to stabilize markets.

6. Acceleration of Strategic Reserves Release

Major consuming economies—like the U.S., Europe, Japan, and India—would likely tap strategic petroleum reserves (SPRs) to stabilize prices. Spokespeople from energy ministries would probably signal coordinated releases to reassure markets and manage volatility.

7. Oil Diversion: Rerouting and Shipping Costs

Countries might reroute oil to avoid the strait. Some ships could journey around the Cape of Good Hope, adding 7–10 days to travel. Hive-shifts among African and Latin American crude exporters might emerge, shifting trade patterns long-term. But short-term, rerouting would translate to sharply increased freight costs, which would trickle down to consumer prices globally.

8. India’s Immediate Concerns

India is uniquely exposed. As of today, over 60% of India’s crude imports flow through the Strait of Hormuz. High dependence on Gulf suppliers—Saudi Arabia, UAE, Oman—amplifies risk. A strait closure would threaten India with supply disruptions, rising import costs, and inflationary pressure—especially in transport, petrochemical industries, and rural fuel.

9. India’s Strategic Buffer Measures

India has accumulated a 5–6 week buffer via its underground SPR facilities. This cushion provides short-term relief. However, maintaining continuity means accelerating procurement from non-Gulf sources such as the U.S., West Africa, Russia, and South America—the latter of which demand diversification of shipping lanes and trade relations.

10. Diplomatic Countermoves by India

New Delhi would likely deepen ties with Gulf producers to preserve access. Talks around alternative routes—like the Iran–Pakistan pipeline, the East–West corridor through the Middle East, or the International North–South Transport Corridor (INSTC)—could gain traction. At the same time, India’s diplomatic balance—between maintaining ties with Iran and aligning with Western strategic interests—will be tested.

11. Emerging Shift Toward Non-Gulf Sources

India’s dependence on Iran for certain crude grades (e.g., heavy sour oils) has been a persistent feature of its portfolio. A prolonged strait disruption could push India into long-term reassessment of reliance on Gulf oil. Instead, India could boost purchases from Russia, the United States, Brazil, and Algeria, even as shipping routes adjust and fuel costs rise.

12. Financial and Infrastructure Ripple Effects

Rising fuel costs would strain inflation targets and fiscal budgets across multiple economies. India’s current account deficit could widen, necessitating tighter monetary policy. Consumers would feel pain through higher fuel prices and transportation costs, leading to pressure on government subsidies and state-owned oil companies.

13. Regional Security and Naval Escalation

A closure could spark naval confrontations—blockading vessels, mine-laying, or tactical strikes. Key militaries—the U.S., U.K., France, India, China, and regional Gulf navies—could be drawn in, increasing the risk of miscalculation. Insurance costs for shipping (war-risk premiums) would escalate sharply, further inflating trade costs.

14. Acceleration of Energy Transition

Crises often speed structural change. Governments and companies may accelerate renewable energy and efficiency programs. Solar, wind, biofuels, and electric vehicles—not to mention hydrogen—would become more appealing as governments seek insulation from Middle East unrest. India’s commitment under its national energy transition plans could look suddenly more urgent and strategic.

15. Long-Term Scenario Planning

Even if the Strait remains open, volatility won’t vanish. Market participants would reassess “risk premiums” pricing in future disruptions. Energy security strategies would gain political credibility. India may ramp up investment into SPRs, alternative routes (e.g. Chabahar, North–South corridor), domestic refining flexibility, and diplomatic hedging.

Beyond geopolitics, Iran’s recommendation to close the Strait of Hormuz is a strategic gambit with profound consequences. Oil prices could spike sharply, shipping logistics would be disrupted, and global markets thrown into turmoil. India—not only reliant on Gulf oil but also sensitive to currency, inflation, and growth pressures—would find itself at the center of the storm.

Response strategies—short-term SPR tapping, supplier diversification, diplomatic outreach—will be crucial. Over the longer term, structural shifts in trade patterns, energy sourcing, and transition goals could fundamentally reshape India’s energy policy framework.

As the standoff continues, the world will be watching. Intensified diplomacy, cautious market regulation, and agile energy planning will define which economies weather the next phase of this crisis—and which falter.